EcoStruxure™ Microgrids: Reliable energy and power distribution | Easily optimize the best times to consume, produce, store, and sell energy

Who can benefit from a microgrid?

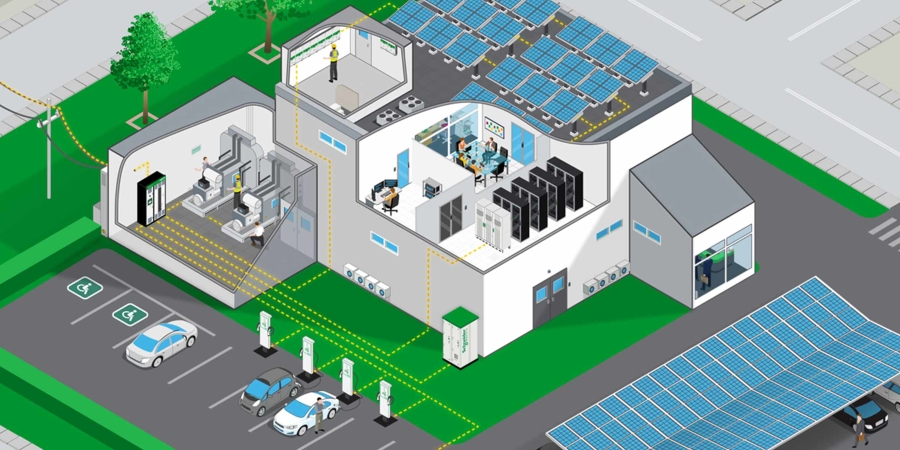

Early adopters of microgrids included hospitals, data centers, and other facilities where reliability and resiliency are essential. Today, organizations of all kinds are turning to microgrids and distributed energy resources for financial and sustainability benefits.

We’ve worked with a diverse set of customers: from municipal governments and military bases to nature preserves and vertical farms. Any organization seeking to gain control over energy costs, advance sustainability, and increase resiliency can benefit from a microgrid.

Additionally, as infrastructure, industry, and buildings continue to become more electrified, microgrids can help generate power for additional loads. For example, increased power needs for EV chargers or electrification of heating.

What microgrid services are available?

No matter where you’re at in your microgrid journey, Schneider Electric can help. Our microgrid services span all stages, including:

- Consulting to design your system and offer insight throughout the project lifecycle

- Modernization to upgrade existing equipment.

- Startup and commissioning to inspect and test equipment, ensuring proper setup and functionality

- Maintenance to keep systems running and ensure successful outcomes.

How much does a microgrid cost to build?

The honest answer is, “It depends.” Microgrids range dramatically in complexity and size.

The exciting answer for organizations is that it can be done with low financial risk. Our energy-as-a-service model allows you to upgrade your energy infrastructure with a customized solution — including a microgrid — and plan ahead with predictable long-term pricing.

If you prefer to build your own microgrid, the costs will vary depending on system size and capabilities. Reach out to us here and we’ll talk through your project.